New Paragraph

BUY? SELL? RE-IMAGINE? HOLD?

Debating what to do next?

Now is the time to discover a more complete picture of the changing market, end-user demands, and capital conditions that are unprecedented.

Whether for a single asset or a portfolio, Adaptiv has unique capabilities to create a timely, effective strategy for your office asset hold or divestiture plan.

What we are seeing now is early stage disruption and far from over. Innovative horsepower that can help just makes sense.

Interested in learning more?

We'd be pleased to schedule a time to talk.

Contact Us

With companies and their employeees working differently, owners are increasingly challenged maintaining good occupancy and financial performance. As companies and their leases expire in the coming years, re-sizing and reducing their space requirement is inevitable.

Companies like EQ/Blackstone, GPT Australia, Parkway Properties, CBRE, MRP, PwC, TechSpace, MakeOffices, among others trust Adaptiv to help find the right answers.

As thought leaders in the future of work and commercial real estate, Adaptiv looks to reshape how their clients think about, invest in and position their commercial real estate investments for successful performance.

The value of U.S. office buildings could plunge 39 percent, or $454 billion, in the coming years, according to a recent study by business professors at Columbia and New York University.

“We see lots of tenants not renewing their leases, going either fully remote, or renewing their leases but signing up for less space,” said Stijn Van Nieuwerburgh, one of the authors of the paper, and a professor specializing in real estate at Columbia Business School. “It all adds up.”

Nov. 17, 2022

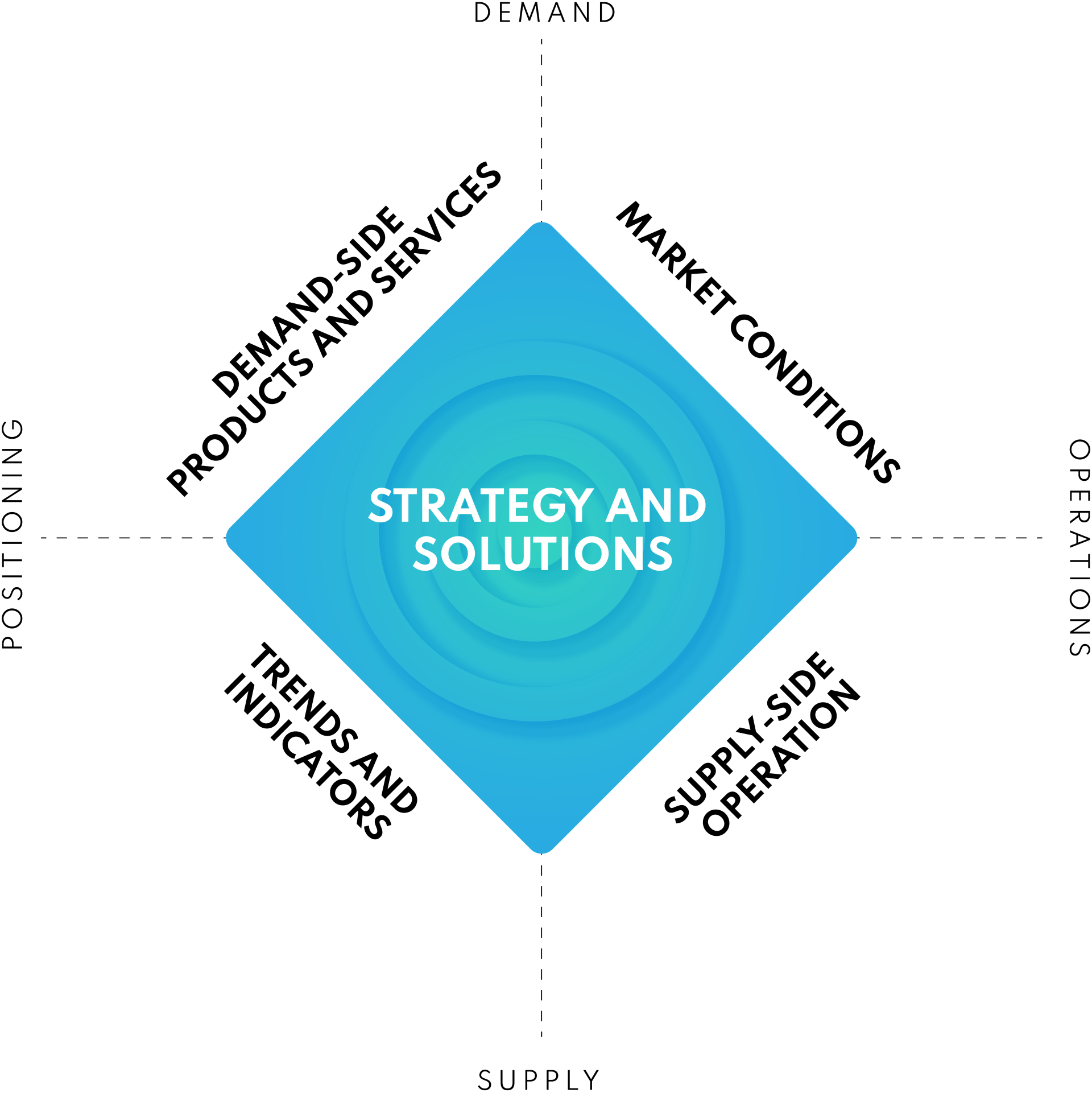

Transforming operating models, assets and portfolios to ensure through-cycle value in a new era of work and place

Trends and Indicators

Develop proprietary customer intelligence, fed by Adaptiv’s CRE Practice that informs asset (re)positioning and ensures tight market alignment

Demand-side

Develop expanded asset- and portfolio-level products and services beyond “term occupancy” that align with demand-profile of local sub-market and existing tenants

Market conditions

Develop a strong brand across the asset through differentiated physical and digital UX that further strengthens value prop for existing and prospective customers

Supply-side

Rebake asset-level operating, marketing and sales models to ensure seamless alignment across expanded products and services within the asset

How we can help

A proven approach to client value creation

Ready to learn more?

Connect with Adaptiv's leadership to see if we can add value to your thinking.

It's going to get much worse before it gets better.